Impressive 2021 growth rates with Singapore leading the pack with 49% installs and 34% growth in sessions

Qinthara Fasya | 11 August 2021

Adjust, the mobile marketing analytics platform, today released its inaugural APAC Mobile App Trends Report 2021, which takes a deep dive into mobile app performance in APAC as the region leads the world in mobile app growth. The report shows just how fast the mobile app market is growing, as more and more people in APAC are using apps to manage their daily tasks and keep themselves entertained.

Installs across all verticals in APAC increased by 31% YoY in 2020, and are continuing to grow steadily in 2021, up by another 4%. Growing 54% YoY, sessions also boomed in 2020 — largely due to the shift to mobile during lockdowns. Consequently, growth in sessions has not been as impressive in 2020 so far:

“While APAC’s overall sessions growth in H1 2021 has only increased by 1%, it is slowly building momentum and has almost reached 2020’s Q1 peak,” said April Tayson, Regional VP, INSEA, Adjust. “This shows that the app industry is retaining users acquired during the recent lockdowns — and continues to bring new users.”

Installs and sessions increased dramatically in every country in 2020 — all continuing to grow in 2021

Based on Adjust’s top 910 apps from APAC, the report draws data from India, Indonesia, Japan, Malaysia, Myanmar, Philippines, Singapore, South Korea, Taiwan, Thailand and Vietnam, showing that:

- So far this year, Singapore and Vietnam have posted impressive install rates — up to 49% and 43%, respectively, during H1, compared to 2% and 27% in 2020.

- Singapore’s sessions have increased by 34% this year, compared to the 1% growth in 2020.

- Vietnam, the only country that didn’t grow in 2020, decreasing 9%, is seeing the inverse in 2021 — with sessions increasing by 12%.

The report also takes a close look at the growth of three verticals: gaming (hyper casual and non-hyper casual), fintech and e-commerce in APAC in 2020 — and their continued growth in 2021. Hyper casual gaming grew the most out of all verticals, with installs climbing 66% YoY in 2020, and 49% in 2021. Fintech takes second place (36% and 18%), followed by e-commerce (27% and 8%) and non-hyper casual games (23% and 4%).

Additional takeaways from the report’s breakdown by country vs vertical include:

Gaming seeing impressive growth in APAC

- For gaming overall:

- Vietnam was the top-performing market in 2020, with a 37% boost in installs YoY, followed closely by Indonesia (34%) and India (33%).

- In H1 2021, Singapore (80%), Vietnam (51%) and Japan (41%) are leading the pack in installs.

- For hyper casual gaming specifically:

- Singapore saw the most YoY growth in installs (112%) in 2020, followed by Indonesia (101%) and Thailand (74%).

- All markets have continued to grow in 2021, most notably Thailand and Singapore at 22% and 21%, respectively.

- For non-hyper casual gaming:

- Japan and Indonesia were the top two markets for sessions in 2020, growing at 42% and 26% YoY, respectively.

- In H1 2021, Singapore and Vietnam are clocking the most non-hyper casual gaming sessions: Singapore’s sessions grew by an enormous 151% YoY, with Vietnam following at 62%.

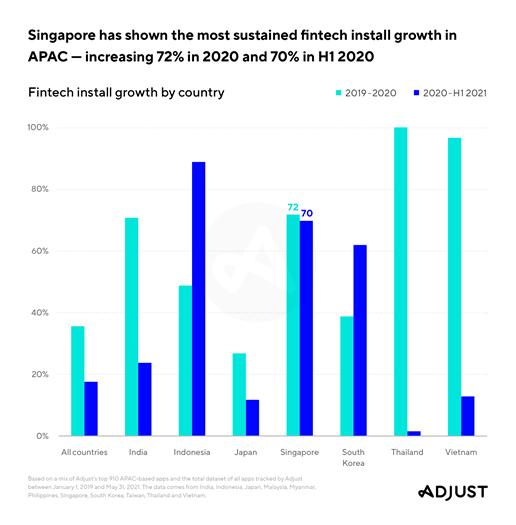

- Fintech in APAC excelled in 2020, as people increasingly turned to mobile banking and payments. The trend continues in 2021.

- Thailand and Vietnam dominated in fintech installs, with massive increases of 100% and 97%, respectively, followed by Singapore at 72%.

- So far in 2021, fintech app installs are surging in all markets, with standout growth in Indonesia (89%), Singapore (70%) and South Korea (60%).

- But Singapore and Vietnam are the real standouts in 2021, with respective sessions up by an eye-popping 188% and 136%.

The report also shows that the time users spent in-app, the amount of sessions they had per day and the length of each of those sessions all grew. This is evidenced by very consistent retention rates throughout the year despite the impacts of the pandemic. In Q4, the day 30 average was 5.68%.

With iOS14.5+ redefining the industry’s approach to user acquisition, and Android 12 on the horizon, collecting granular data points on user behaviors and in-app patterns is becoming increasingly important. With this data, developers and marketers can do A/B testing to understand what users expect and how to optimize the in-app experience to better meet their needs.

For additional findings, download the full report here.

About Adjust

Adjust is the mobile marketing analytics platform trusted by growth-driven marketers around the world, with solutions for measuring and optimizing campaigns and protecting user data. Adjust powers thousands of apps with built-in intelligence and automation, backed by responsive global customer support.